The growing adoption of the Internet from electronic commerce to social media to distance learning has provided opportunities for growth and development even during the more recent bouts of lockdowns and stay-at-home measures. But those optimistic prospects have perennially come with risks of virus attacks and financial scams as well as personal abuse in the form of cyberbullying and identity theft that are often not properly attended to.

“We know that Filipinos are very active in social media, online shopping, and banking, which makes them exposed to cyber risk. Thus, we want to offer them protection with MyCyberProtect Mate,” says Chief Underwriting Officer, Sharon Navarro.

FPG Insurance, a major player in the non-life insurance industry in ASEAN, is introducing its latest innovative solution in the Philippines called “MyCyberProtect Mate” which provides protection against cybercrime ranging from online fraud to cyberbullying and identity theft. The company, known for its long-standing reputation for dynamic, customer-focused engagement, is expected to extend an extraordinary level of service as it has shown in its extensive insurance portfolio.

Navarro explained that the FPG wants to provide assistance to Cyber Risks, “Customer will just need to call the 24/7 call assistance hotline to inform the issue. The customer will then be guided through the process of immediately securing the customer’s e-accounts and the claim documents that need to be prepared/submitted,” said Navarro. “If fraud resulted in the loss of US$ 1,000, we will reimburse the exact expense up to the limit of the coverage.” Navarro also highlighted that FPG wants to provide assistance to victims of cyberbullying through reimbursement of costs for psychological consultation. The “MyCyberProtect Mate” will become both your defense and offense partner to remedy online breaches.

“MyCyberProtect Mate” insurance solution comes with the following features:

- On online purchases: Insurance claim on items bought online that have not been delivered to the customer at all;

- On Internet payment scams: Covers financial losses arising from unauthorized transfer of funds to online bank accounts, e-wallets, or credit/debit cards caused by phishing and social engineering, pharming, malware, and fraudulent electronic fund transfer;

- On identity theft: Compensation to recover, for example, public records in the course of processing a new passport and other related documents.

- On cyberbullying: Financial assistance for psychological consultation, relocation costs, online reputation restoration, and legal expenses of the insured bullied, provided the incident is reported within 72 hours of discovery.

- 24/7 assistance services: Round-the-clock hotline manned by dedicated cybersecurity experts who are ready to provide support to the insured;

The process of compensation or reimbursement will require the submission of documents and related proof that cybercrime has been committed against the insured. The reimbursement will also depend on the insurance policy.

Gigi Pio de Roda, President, and CEO of FPG Insurance Co., Inc . said, “This new product is part of our continuing efforts to provide Filipinos with innovative non-life insurance product solutions. My Cyber Protect Mate will help keep safe every Filipino’s hard-earned money.”

Pio de Roda added that FPG wants to enable every victim of cyberbullying to start over and go back to their normal life. “As its name implies, we are your mate, your friend, and your ally that will handhold you on your recovery from cyber fraud, identity theft, or cyberbullying.”

FPG has on its insurer’s sights at least 10% of the 43M Internet users in the Philippines. Every customer can look forward to a straightforward application process and insurance claims by calling the 24/7 hotline, CyberScout. Moreover, FPG adapts to local culture and customs so every action recognizes the social peculiarity of the individual insured.

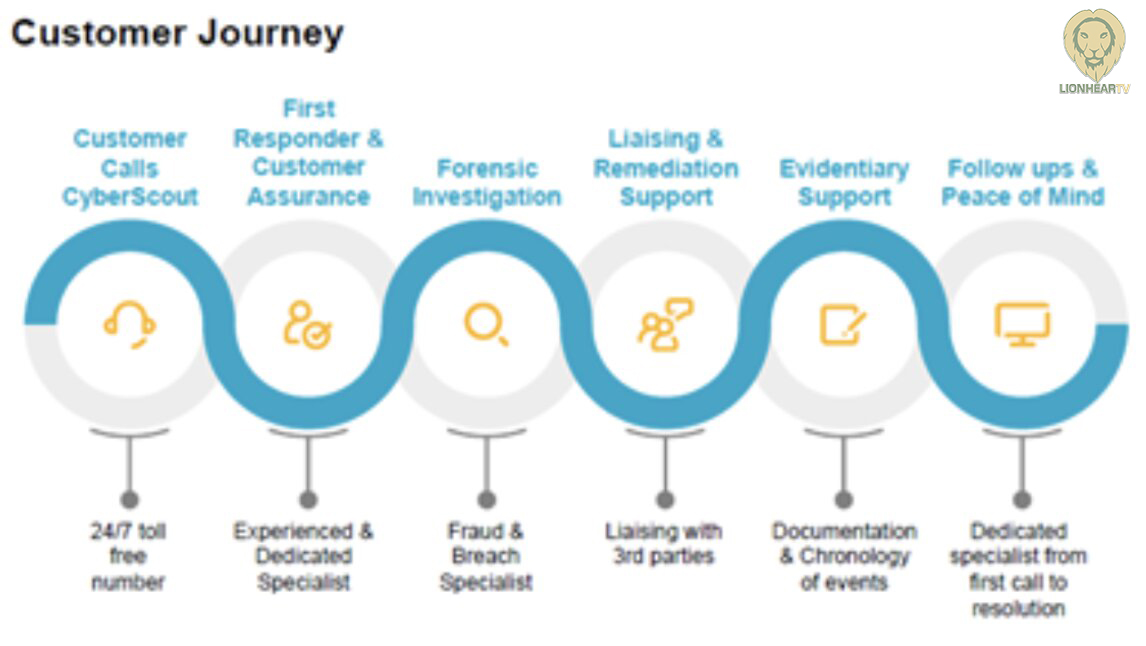

Below are illustrations of a prospect’s journey:

“Prospective customers can apply online so the process is as easy as clicking a form and filling out information online. Then, depending on the policy, the insured can choose to file her claim online so there’s less stress and reduced time in processing the claim. Needless to say, all information is kept confidential and protected by cutting-edge cybersecurity systems in keeping with our working motto that the customer always comes first,” said Navarro.

Pio de Roda concluded, “As we continue to lead through innovation and service, we look forward to continuing this legacy as we celebrate our 65th anniversary next year.”