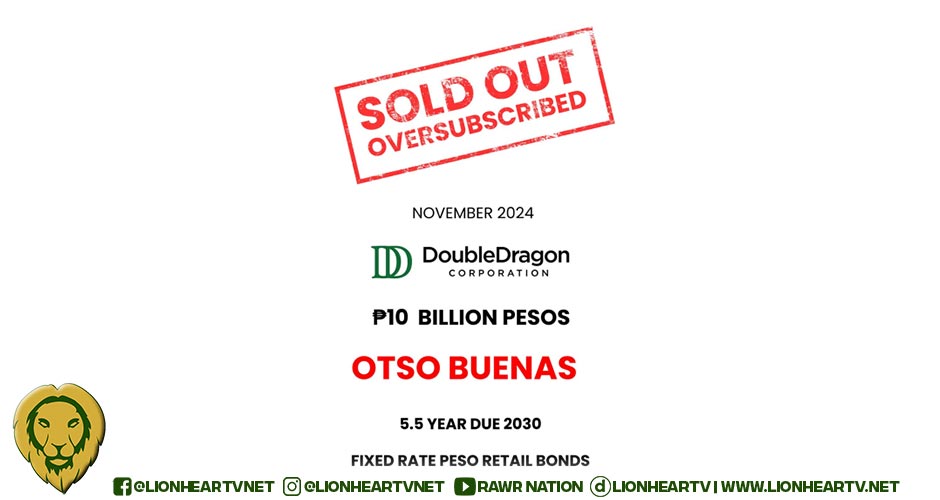

Due to the very high volume demand of orders that came in after the Offer Period started, DoubleDragon Corporation as the Issuer, together with RCBC Capital Corporation, Landbank (LBP) and Unicapital Inc. as its joint lead underwriters, joint issue managers and bookrunners formally announce that the retail bond offering of DoubleDragon Corporation has been more than fully subscribed as of November 18, 2024.

Accordingly, pursuant to the terms and conditions of the retail bond, the Issuer and the joint lead underwriters, joint issue managers and bookrunners have agreed to shorten the offer period, which has o fficially ended on Monday, November 18, 2024, instead of Wednesday, November 20, 2024.

We seek the understanding of the investing public for cutting short the DD retail bond offer period due to oversubscription way ahead.

As DD continues to expand in the Philippines and in various countries overseas, the solid support of the investing public demonstrated in this retail bond offering means a lot as we pursue the vision of DoubleDragon together.

“We are very glad on the early oversubscription outcome of this DD Otso-Buenas Peso Retail Bond offering, enabling DoubleDragaon to capture an even wider stakeholder base into DoubleDragon’s ecosystem, said DoubleDragon Chairman Edgar “Injap” Sia.

“We are deeply grateful for the trust and confidence of the investing public as manifested in this retail bond offering, this will further inspire our whole team to continue the grit and hardwork that we believe is essential to enable DoubleDragon to reach greater heights and become more and more relevant and durable as years go forward”, added Mr. Sia.