Mikael Daez opens up how he and his wife, actress Megan Young, had secretly been engaged seven years before announcing it two years prior to their wedding.

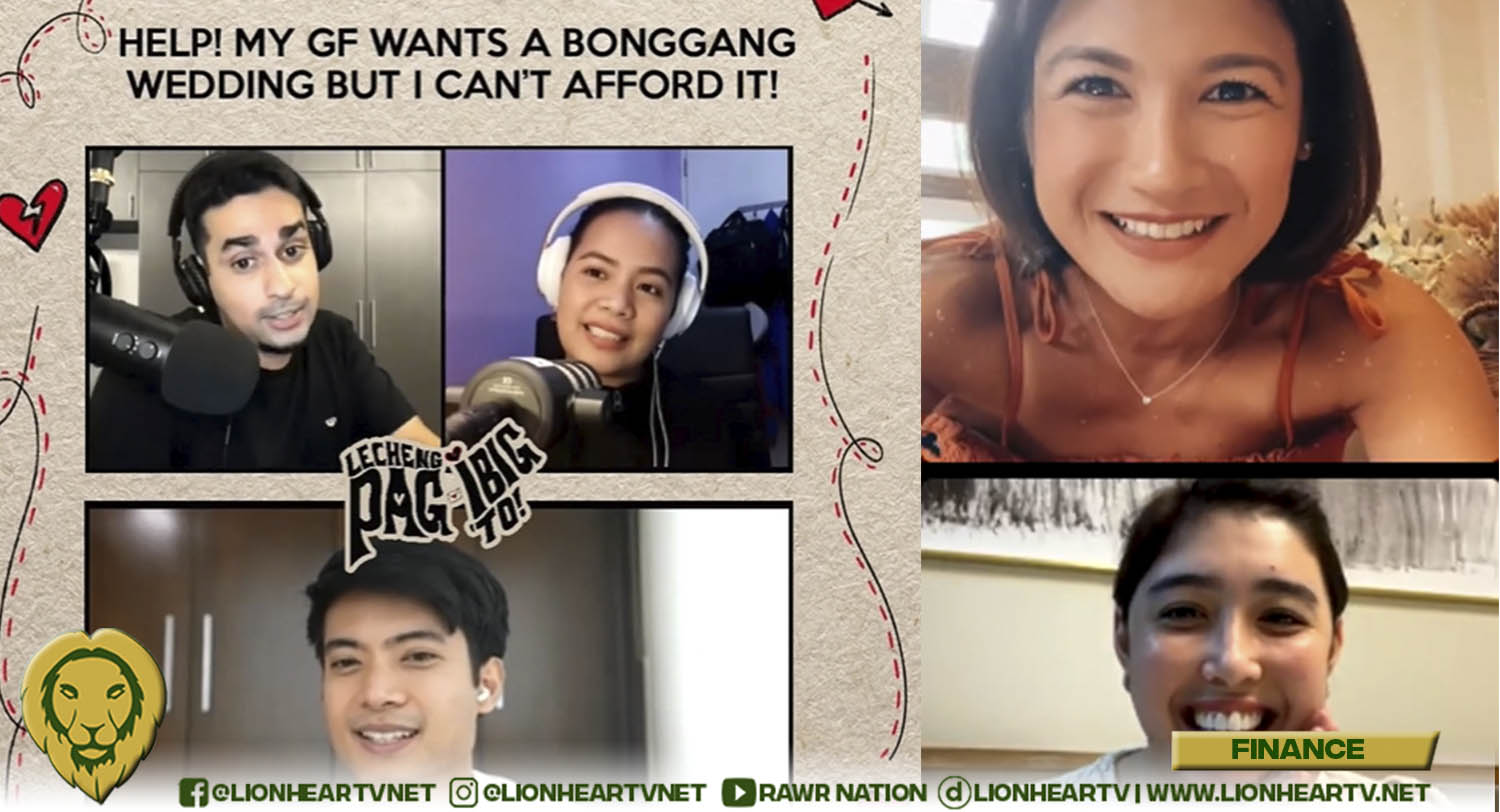

Mikael Daez joins Sam YG and DJ Cha-Cha’s Lecheng Pag-Ibig podcast and recalls that leading up to popping the question, he had no intention of asking but just felt like the timing was right. “It was very spontaneous, I just remember having yummy adobo somewhere and on the car ride home I just knew. I started building up to the question with a 4-5 minute speech then when we got to her place I asked her. We only announced it to the press in 2018,” Mikael says.

Sam, who will soon be married himself to his non-showbiz fiancé, opens the discussion about wedding planning and budget priorities. Mikael says that he and Megan’s priorities were a wedding coordinator for easier decision-making, more affordable but still eye-catching food choices, and while it was the priciest, an event stylist was crucial for their big day.

The episode also featured a letter sender who sought advice on challenges that he and his fiancé were facing like spending on a house or a dream wedding. From his personal experiences, Mikael shares how he and his wife are managing their finances. “Even before we got married, we opened up about how much we earn and how we budget it. Fast forward years later, we had a system down, what’s mine is hers and what’s hers is mine.”

Sam then brought up how the UnionBank app has been helpful with his savings. “UnionBank Online actually has a feature that helps you with your savings whether it’s a car, travel, wedding, and every month a portion of your money is automatically allotted to each.”

Mikael adds, “We use the UnionBank Online app and we have these placeholders where we want to save and we let that dictate how we spend. It gives us freedom to buy what we want — Megan can spend on her keyboard, no fail, no guilt — knowing savings have already been predetermined.” He shares that this system has allowed them to plan their spending properly while also being able to enjoy what they want, especially their travel fund which has been growing since the pandemic started.

Sam also shares how he is currently budgeting for his wedding. “One of the things I talked about with my fiancé is that money and spending habits should really be discussed before a wedding.”

“At the end of the day, it’s up to you to talk about it and discuss what really matters. But also, if you’re worrying about wedding planning or building your house, start enjoying the ‘My Goals’ feature of UnionBank Online, you will reach whatever you want to do one step at a time,” Sam adds.

Mikael ends with advice that anyone getting married shouldn’t have their relationship strained by pressures on the wedding or spending. “Before they make decisions about money or the wedding, alamin muna nila priorities nila. Kami ni Megan, nag-align kami. We don’t want to put all this pressure of our love on this one day. Our love will not be defined by this one wedding day.”

Life after the I DO

Camille Prats-Yambao has been on a roll — she’s been successfully juggling work and fitness, spending time with her kids and husband, and posting high-level content for all her followers. In her recent IG live, she sits down with long-time friend Dani Barretto-Panlilio, to keep each other up to date about topics like motherhood, ‘alone’ time, and the convenience of navigating through the digital space.

For Dani, her lifestyle brand “The Mill” was launched and experienced immense growth during the pandemic while she is also able to spend time with her two-year old daughter, who the business was named after.

Camille talks about staying in Batangas during the beginning of the previous ECQ (Enhanced Community Quarantine), so that her three children have a place to run and play while they await the construction of their new home. For Dani’s end, she took a big step as a mom by enrolling Millie to an online school. “Ang mature na ng mga ginagawa ko sa life,” Dani laughs.

However, Dani further notes how she felt uninspired and lost at one point during this pandemic. But things started turning around when she started her business. “I was always scared to start something but thankfully God guided me and that’s when I started my brand, The Mill.”

Camille also shares her struggles when it comes to paying suppliers for her new house that they’re currently building. She can’t go to a bank to deposit a check and there are also limits to fund transfers.

After making the switch to online banking, Camille has had a seamless experience. “I’m now able to pay for our suppliers digitally with my UnionBank Online account. I was even able to save their account numbers for future payments without having to manually type it over again.”

“It’s perfect for us moms because we get confused easily but at least with Unionbank, everything is detailed and easy to use and you get to save account numbers,” Camille adds.

Dani also shares how the UnionBank Online app has helped her a lot during the pandemic. “You need to find that banking partner, a partner that will help you get through this all. Because once I am able to accomplish all my daily responsibilities like paying suppliers and settling my bills with UnionBank, I can finally play with Millie, take a nap, and do other things! It really doesn’t take so much off my time anymore.”

Safety and convenience are just a few clicks away. Like Mikael, Sam, Camille, and Dani, managing finances is a breeze with digital banking and UnionBank Online. Make smarter decisions, and experience safety and convenience when you bank the way you live. To learn more about UnionBank, visit unionbankph.com. Download UnionBank Online to open an account.