The unforeseen volatility of the past year spared no individual or industry from the far-reaching effects of the COVID-19 pandemic. From a wealth management perspective, in situations like this, clients need an anchor- somebody to advise them on their investments, constantly communicate with and update them, and help navigate their wealth portfolio through the uncertainty. For many clients, Unionbank Private Banking served as their anchor.

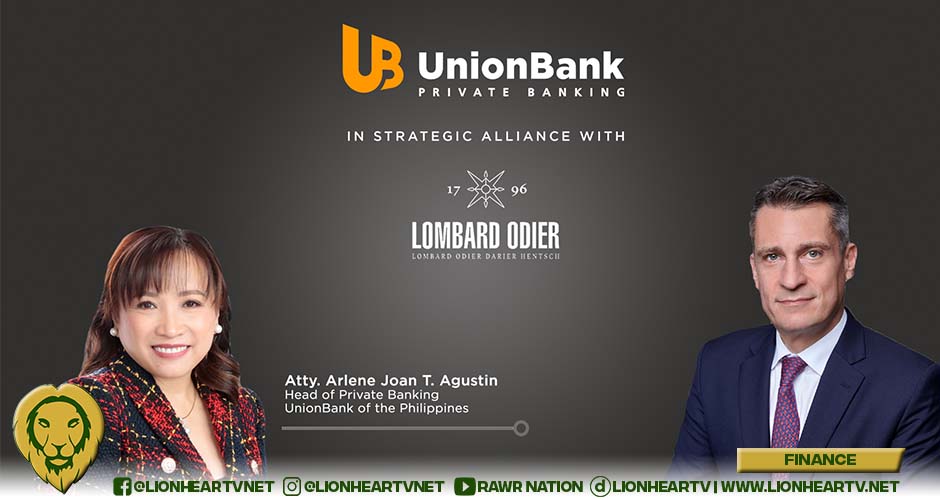

“Our clients have turned to us more than ever for guidance while the world has faced unprecedented challenges from the COVID-19 pandemic. This shared trust for UBP Private Banking and Lombard Odier enables us to actively engage and serve our clients, to not only weather the crisis but to thrive in an environment that requires a risk-based and technology-driven approach to preserving and managing wealth,” said Atty. Arlene Joan T. Agustin, Senior Vice-President and Head of UnionBank Private Banking Group.

A relatively new entrant to the local wealth management landscape, UnionBank Private Banking is in a strategic alliance with Lombard Odier, a leading global wealth and asset ¬-manager headquartered in Switzerland with 225 years of private banking experience. UnionBank draws on Lombard Odier’s vast wealth management and family services expertise, and its two-century history of innovation, to unlock global opportunities for its local private clients.

“We believe the future of private banking is also onshore. Beyond wealth management and family services expertise, our strategic alliance with UBP Private Banking provides clients with access to opportunities and privileges beyond their borders. The ecosystem of strategic alliances in Asia allows like-minded families, business, and entrepreneurs to connect across the region, in markets that they may not traditionally have had access to. Our network is your network,” said Vincent Magnenat, Limited Partner & Chief Executive Officer, Asia, Lombard Odier.

In 2020, Lombard Odier and UnionBank Private Banking, together with Lombard Odier’s other strategic alliances in the region, conducted a study and engaged in conversations and interviews with more than 150 of Asia’s UHNWI in the New Normal. The results of these efforts were elucidated in a whitepaper entitled “Connection, Transition, Transformation: engaging Asia’s UHNWI in the New Normal” and was formally launched in February 2021. The whitepaper focused on four main areas of interest of the UHNW clientele: Family Services, Sustainability, Investment, and Technology.

As a multi-generation Aboitiz-led Bank, and in strategic alliance with Lombard Odier, UnionBank Private Banking has established credibility and experience in providing clients with advisory services on Family Services, including Succession Planning, Wealth Management, and Family Business transition across generations.

UnionBank Private Banking takes pride in developing and hosting the NextGen Academy, a multi-awarded event series designed to empower and set the entrepreneurial foundation for the next generation family business leaders. In 2020, the NextGen Academy was named:

• Best Next Generation Offering by Retail Banker International at The Private Banker International Global Wealth Awards 2020

• Best Next-Gen Offering by The Digital Banker for the Global Private Banking Innovation Awards 2020

• Best for Wealth Transfer / Succession Planning by Asiamoney during the Asiamoney Private Banking Awards 2020

The NextGen Academy has definitely become a staple event of UnionBank Private Banking as it shows great potential as an avenue to cultivate a sustainable and “sticky” relationship with clients that will last generations.

“I am extremely grateful for the opportunity to hear from such a great panel and I’m glad to say I learned a lot that will truly help in future business endeavors both in and out of my family’s businesses,” a participant of the NextGen Academy Online 2020 said.

Apart from the NextGen Academy program, clients also benefit from regular subject-matter specific webinars, with topics such as Cybersecurity, Tax Planning, regular Economic & Market Briefings, among others.

Together with Lombard Odier, a leading global advocate for Sustainability, UnionBank Private Banking aims to localize and pioneer Sustainability in the Philippines, by training its bankers to be advocates for sustainability and sustainable investments, making available sustainability-themed investment outlets, and looking to incorporate socially responsible practices in its operations.

UnionBank Private Banking provides clients with wealth management and investment services to help them structure an optimal investment portfolio, taking into consideration their return objectives and risk profile. Through the group’s strategic alliance with Lombard Odier, clients are given access to world-class investment strategies, within a core-satellite investment philosophy. An open-architecture structure ensures that clients will have the opportunity to invest in best-in-class investment outlets. A wide array of global mutual funds and exchange traded funds may also be made available to clients, upon inquiry.

The group’s strong commitment to providing outstanding service did not falter even during the height of the pandemic.

“We appreciate that you were able to open our accounts despite the limitations during this crisis. One of the few banks that [is nearly fully operational even at this time]. Very efficient process,” a valued Private Banking client said.

“On behalf of [our company and family], we would like to thank you for the extra mile assistance in facilitating [our requirements] despite the lockdown situation. We greatly appreciate [this],” another valued Private Banking client said.

UnionBank is recognized as one of the leading trailblazers of innovative digital banking services in the local landscape. The Bank continues to invest in and utilize various new and emerging technologies, which is a testament of its commitment to digital transformation in the long run.

UnionBank Private Banking seeks to empower its clients by providing them with access to global investment capabilities with a local touch, with a commitment to Sustainability and sustainable investing, offering bespoke wealth management & family services advisory – to be a Private Bank fueled by a strong commitment to its clients and one that defies boundaries and unlocks possibilities.